The real estate market in 2025 offers unique opportunities for investors who understand its dynamics. From timeless investment principles to current trends in mortgage rates, sales, and rentals, here’s how to position yourself for success in today’s shifting landscape, with a focus on actionable strategies and local insights from the Wilmington, NC, area.

Timeless Investment Principles

Successful real estate investing starts with a long-term mindset. Warren Buffett’s advice remains relevant: hold quality assets indefinitely, as their value compounds over time. Diversifying your portfolio with multiple properties reduces reliance on a single income source, mitigating risk. Most importantly, risk stems from ignorance—knowing the market is key. Prioritizing time in the market over timing the market ensures you capitalize on opportunities rather than waiting for the “perfect” moment.

Understanding Real Estate Cycles

Real estate markets move through four phases—recovery, expansion, hypersupply, and recession—each lasting 3-5 years, with full cycles spanning 12-18 years. We’re currently transitioning from a seller’s market (2020-2021, marked by low inventory and rising prices) to a buyer’s market. Indicators include increasing inventory, longer time on market, and stable pricing. Nationally, active listings hit 1 million in May 2025, a 31.5% year-over-year increase, with 19% of listings seeing price cuts. This shift gives buyers more negotiating power, especially in inventory-rich areas like Brunswick County, NC, with a 7-month supply.

Mortgage Rates and Financing Opportunities

Mortgage rates are stable, offering clarity for investors. As of late June 2025, conventional loans for primary residences are around 6.8%, with investment properties in the low 7s. Predictions from the Mortgage Bankers Association suggest rates will remain steady through 2026, making now an ideal time to lock in fixed-rate financing. Working with an adaptable lender who offers competitive rates and local expertise can lower closing costs and streamline creative financing, such as fix-and-flip loans or home equity lines. This stability supports long-term investments without the need to wait for rate drops.

For conventional mortgages I recommend connecting with Drew Blakely from Loan Steady, here: https://drew.loansteady-pos.com/

For debt-service-coverage-ratio (DSCR) loans I recommend connecting with Scott Wolf from Lending One here: https://lp.lendingone.com/partnership-cedar-ridge-management

Sales and Rental Market Trends

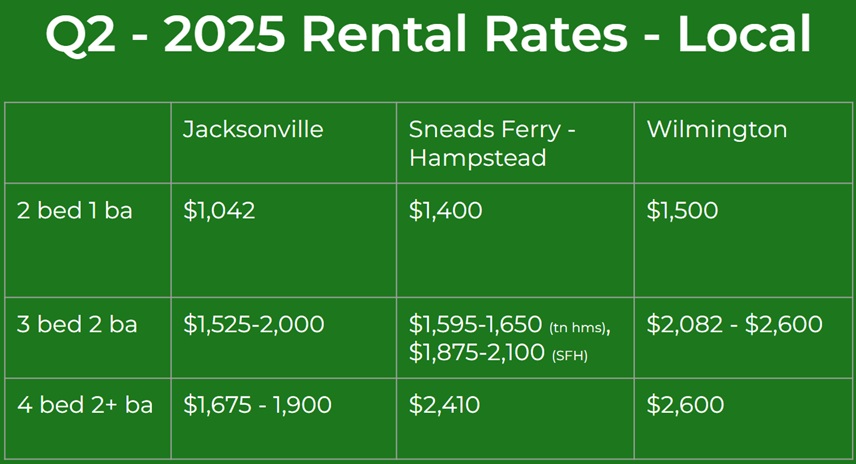

The sales market is cooling, with national inventory at its highest since 2019. In Wilmington, NC, the market is shifting toward equilibrium. New Hanover County shows 6% year-over-year price growth but a 5-month inventory supply, indicating a buyer’s edge—59% of May closings were below list price. Brunswick and Pender Counties are flat, favoring buyers with 7 and 5.5 months of supply, respectively. Rental rates dipped 1% nationally in April 2025, and locally, Onslow County has 254 single-family homes for rent, with properties over $2,500 sitting for 60+ days. However, well-priced 3-bedroom, 2-bath homes (e.g., $1,595-$1,650 in Jacksonville) lease quickly (less than 30 days), driven by positive migration to North Carolina.

Want to buy a rental? I recommend connecting with Sean McDonnell from Quiet Waters Realty Group, book a call with him here: https://quietwatersrealtygroup.com/contact-us/

When you work with Sean or anyone on his team, you get the real estate advice, and rental power of Cedar Ridge Management helping you and Sean find the perfect rental for your portfolio!

Actionable Strategies for 2025

Invest for the Long Haul: Buy quality properties in high-demand areas like Wilmington to hold indefinitely.

Diversify Your Portfolio: Spread risk by acquiring multiple income-producing properties.

Negotiate Aggressively: Leverage high inventory to secure deals below list price, especially in buyer-leaning counties.

Focus on High-Demand Rentals: Target 3-bedroom, 2-bath homes priced under $2,500 for fast leasing.

Partner with Experts: Work with lenders and agents who understand local trends to optimize financing and purchases.

Real Estate Agent, Sean McDonnell

Conventional Loans: Drew Blakley

DSCR Loans & Fix and Flip Loans: Scott Wolf

All The Rental Info You Need: Heath Sizick

*Just need a FREE rental analysis? Click here

*Want to join our next quarterly webinar? Sign up here

With rising inventory and stable rates, 2025 is a prime year for investors to act decisively. Contact a trusted real estate professional or visit cedarridgemgmt.com to explore opportunities and build wealth in this buyer-friendly market.

Book a call with your #1 Real Estate Investment Advisor Today!

https://www.cedarridgemgmt.com/contact